Salary Schedules Redesign

A redesigned workflow that gives HR teams a faster, more transparent way to manage grades and steps.

View project →

65% agency adoption and improved year-end accuracy for W-2 reporting

Unified year-end reporting into one trusted workflow, replacing fragmented processes and reducing compliance risk for more than 200 public sector agencies.

Lead Product Designer

Project Manager, Dev Lead, QA

12 weeks

SaaS platform for government HR and payroll teams

KPI Highlights

65%

$4M+

15%

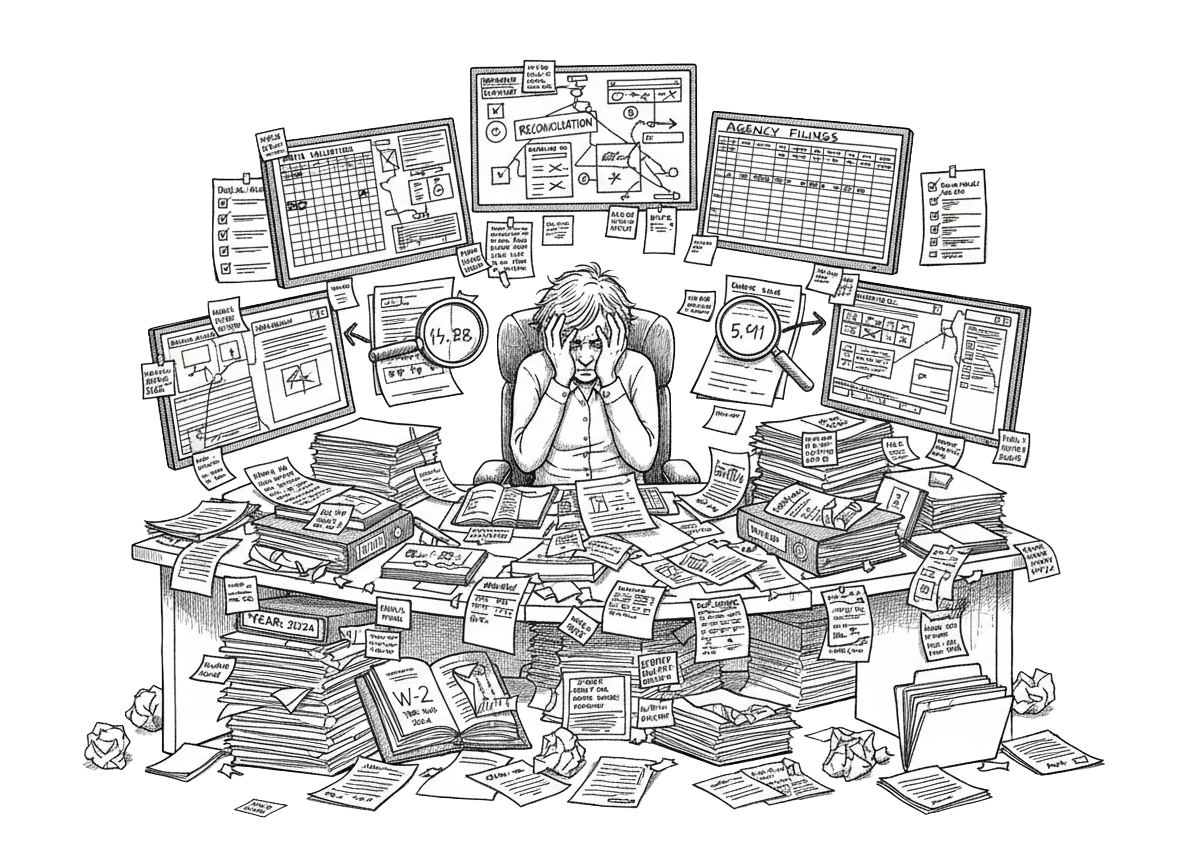

The Problem

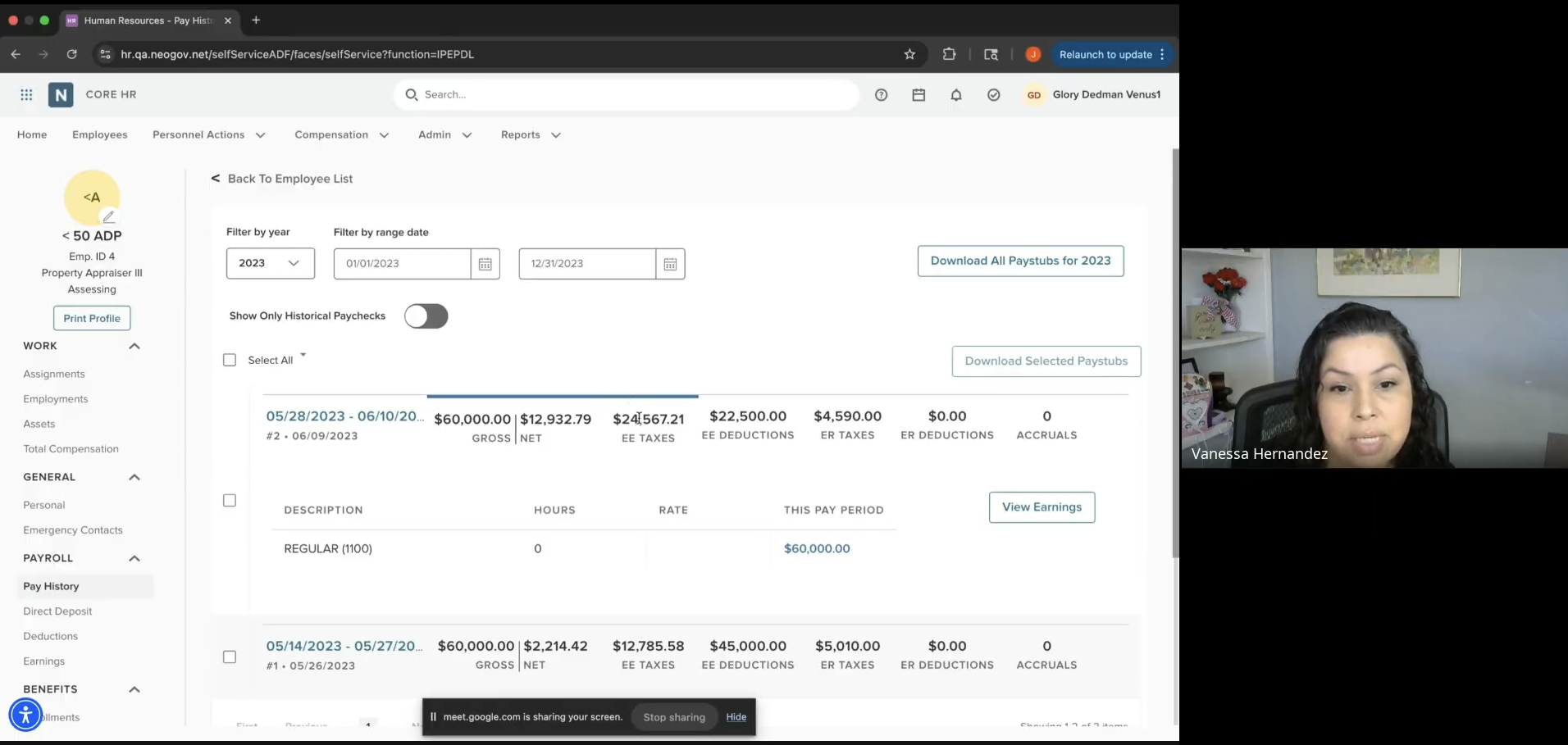

Payroll teams relied on disconnected screens and spreadsheets to validate data before filing W-2s. This created unnecessary cognitive load, manual rework, and accuracy risks during the most time-sensitive period of the year.

Project Goal

Create a unified, reliable experience for year-end reporting that:

Reduce Manual Work

Improve Clarity

Increase Filing Confidence

Foundational Learning: Understanding the Payroll Compliance Ecosystem

I began by grounding the work in the compliance ecosystem and real workflows:

IRS W-2 Requirements

W-2c Correction Logic

Payroll Data Structures

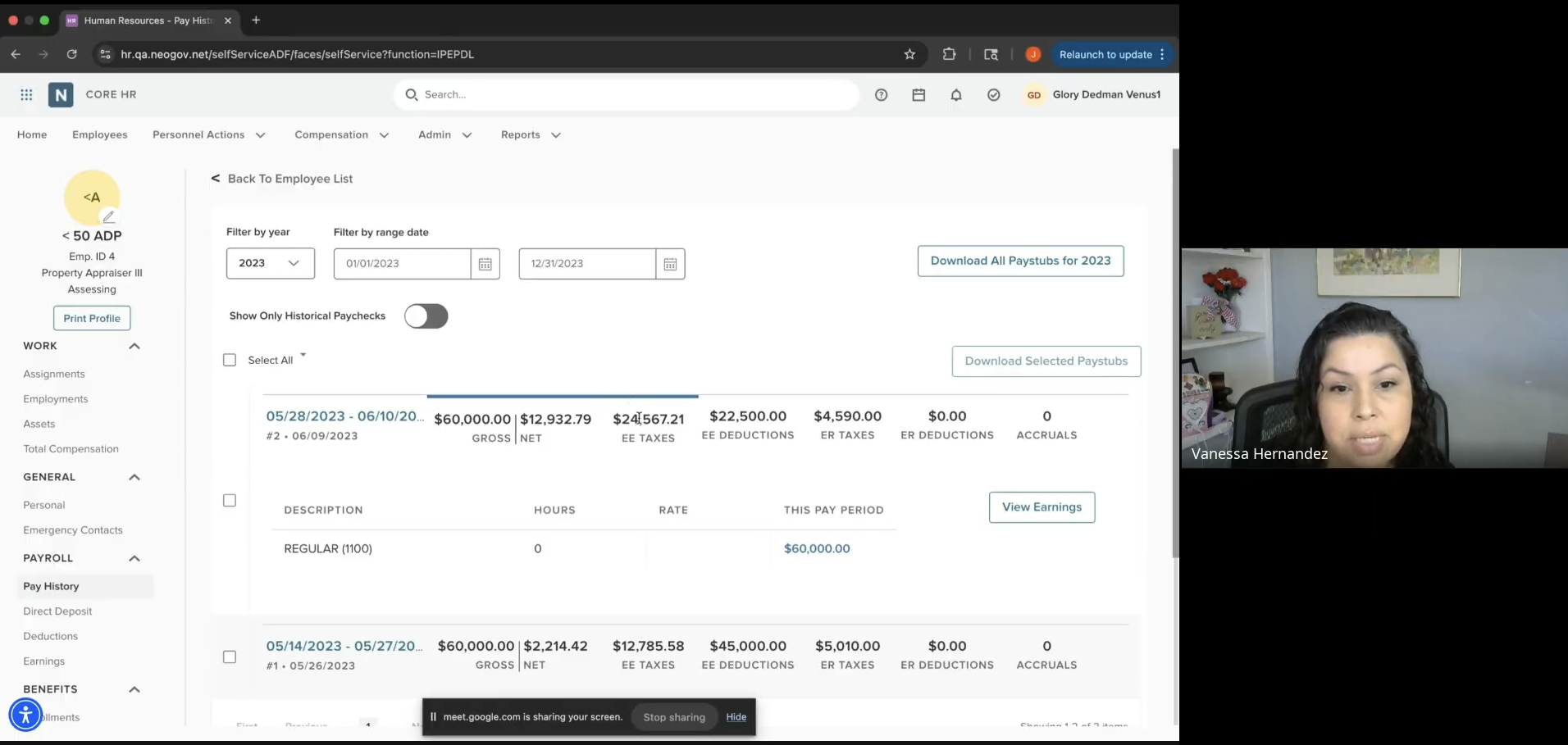

Legacy Workflow Audit

From Context to Discovery

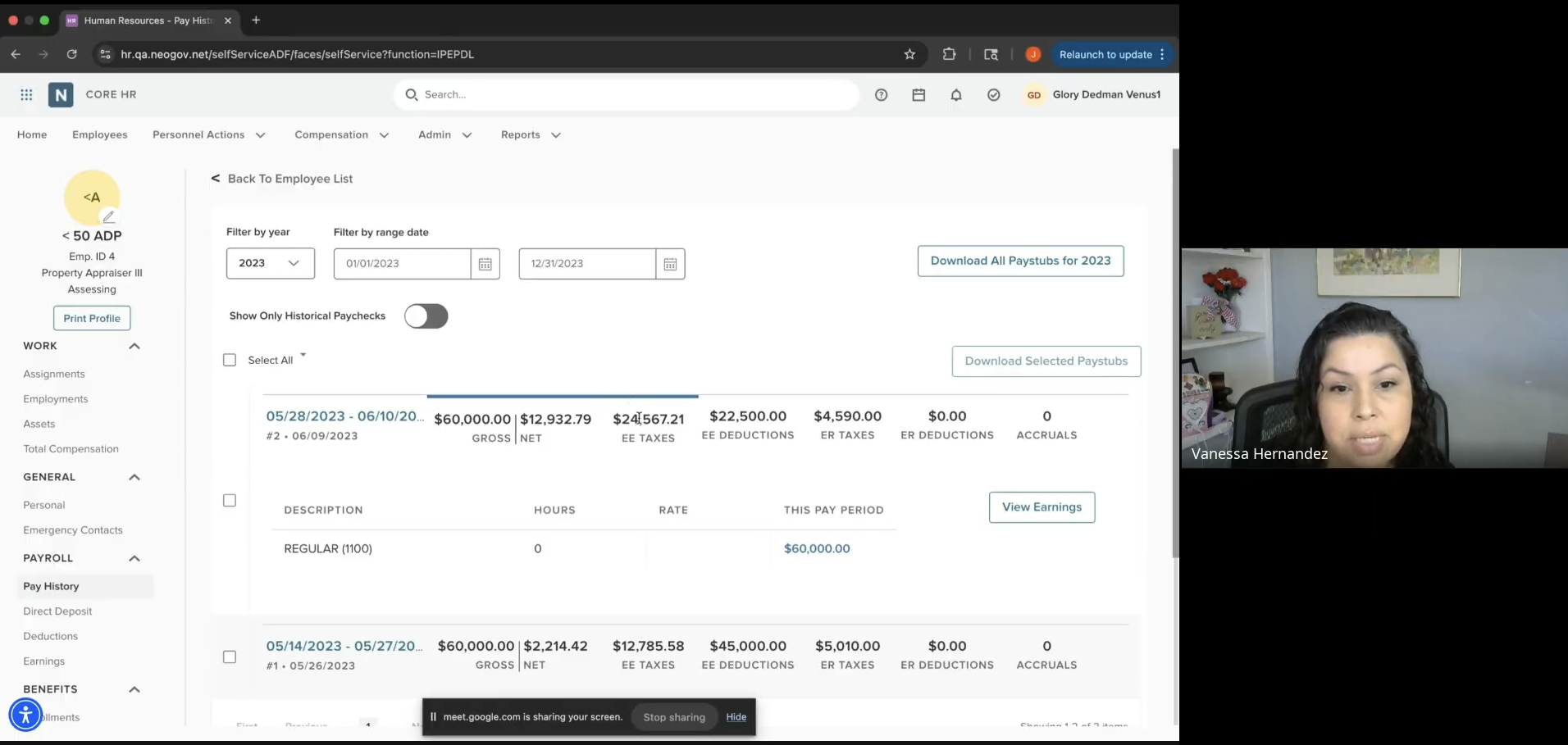

With the compliance basics in place, I moved into structured discovery to understand how year-end reporting actually works in practice.

(2-week sprint)

Week 1

Weeks 2–4

Payroll admins and HR specialists with hands-on W-2, ACA, and 1099 reporting responsibilities.

What the Research Revealed

Over 12 user interviews (payroll admins across multiple agencies) validated the core problems:

Too many disconnected screens

Renne Hotz, Mohave Community College

Manual spreadsheet work

Tiffany Alsdorf, City of Durango

High cognitive load during deadlines

Ashli Perez, City of Arizona

Unclear state and local filing paths

Emily Wolf, City of Wildomar

Mapping the real workflow exposed where reporting breaks down

From Insights to Requirements

Once we synthesized what we heard, we shifted into weekly working sessions with PM, engineering, and payroll SMEs. The goal was to align on what the product should support immediately and what should wait, so we could reduce risk and increase clarity for both users and delivery teams.

We translated the findings into a shared problem statement and high level MoSCoW priorities that guided scope across the first release.

How might we create a unified reporting experience that supports real year-end complexity while reducing the manual checks, fragmented steps, and risks payroll teams face today?

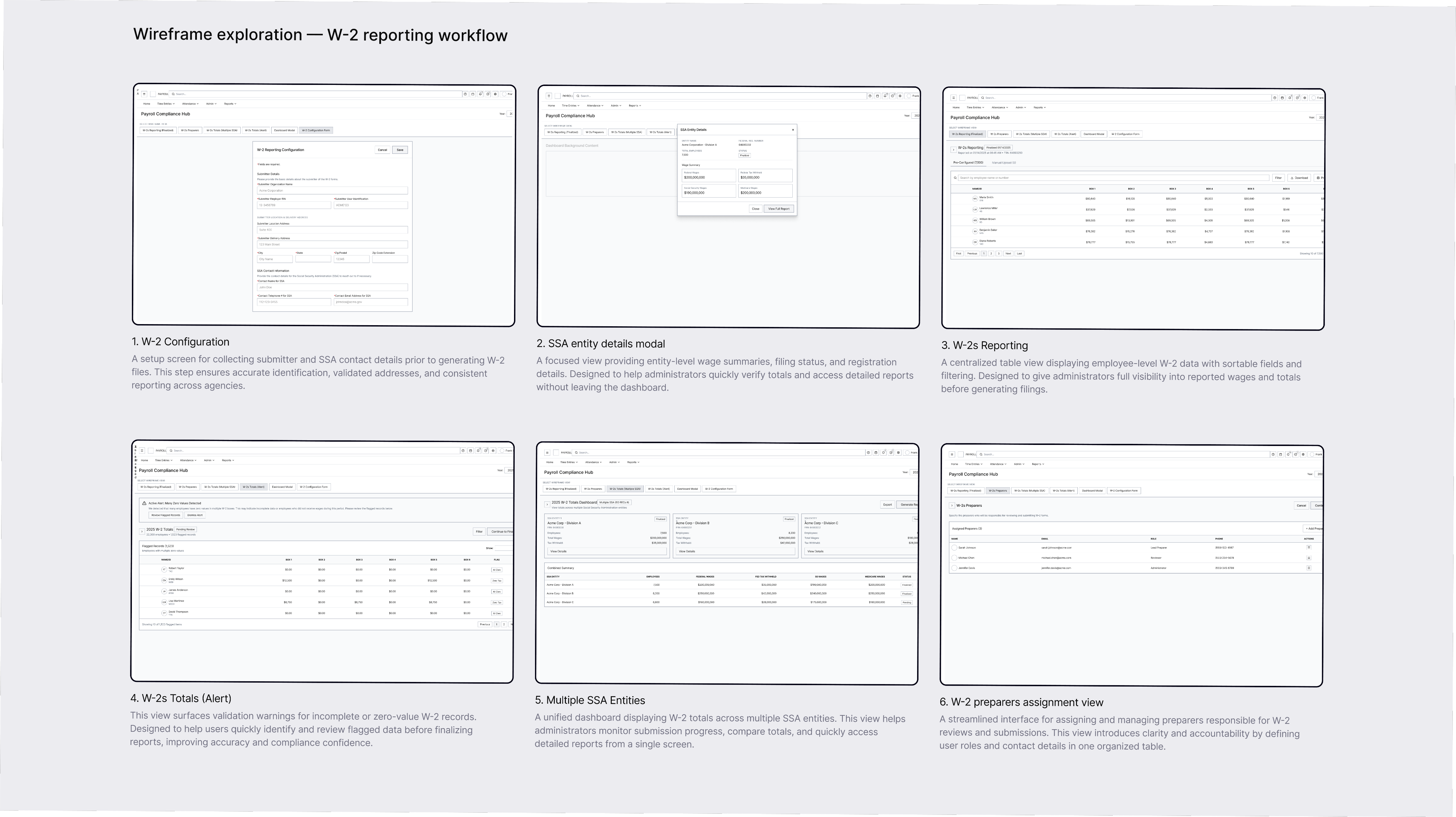

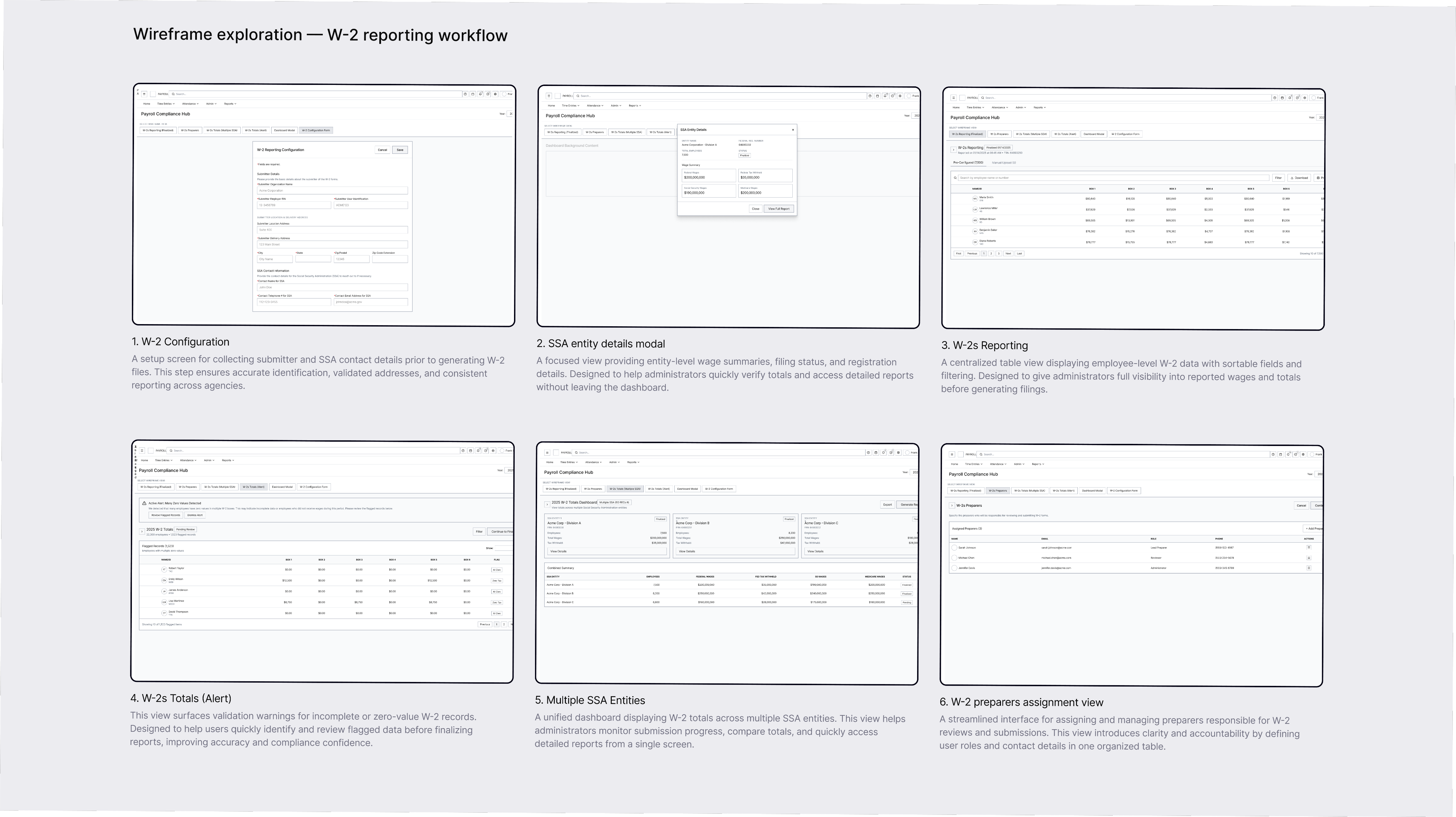

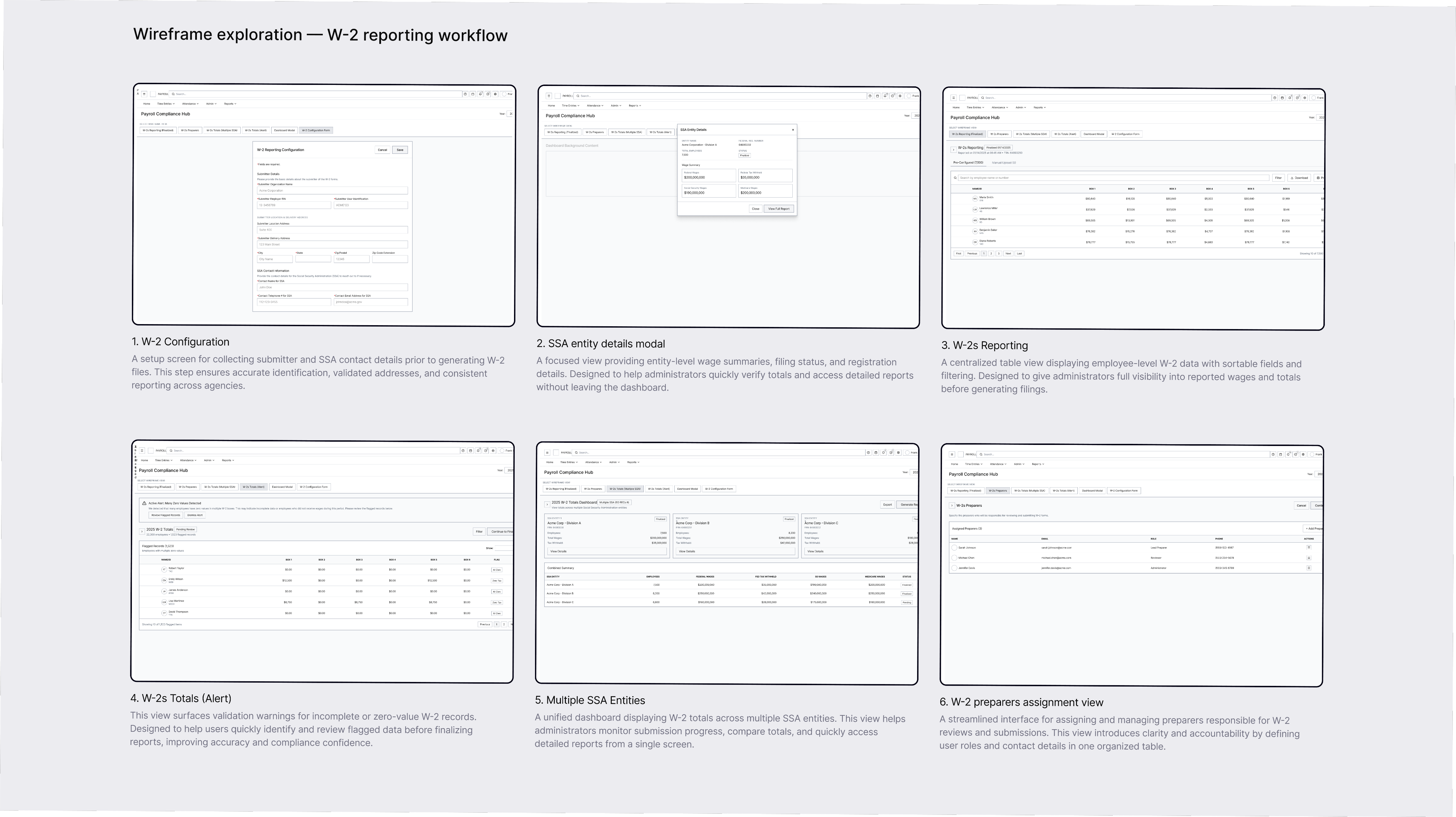

Rapid Low Fidelity Exploration

With the scope aligned, the first sprint focused on fast iteration. I explored multiple layout patterns, workflow sequences, and validation approaches at a fidelity that encouraged honest critique.

SME Alignment and Domain Validation

Internal HR and payroll experts pressure tested early thinking. Their experience validated the problem and exposed gaps that users expect systems to solve.

— Payroll Compliance SME

— HRIS SME

— Implementation Consultant

Mid Fidelity Refinement and Visual Direction

By sprint five, the workflow, logic, and dependencies were defined. This was the moment to clarify how the experience should feel in practice.

That meant:

Where We Are At Now

Alignment

Confidence

Momentum

What We Delivered

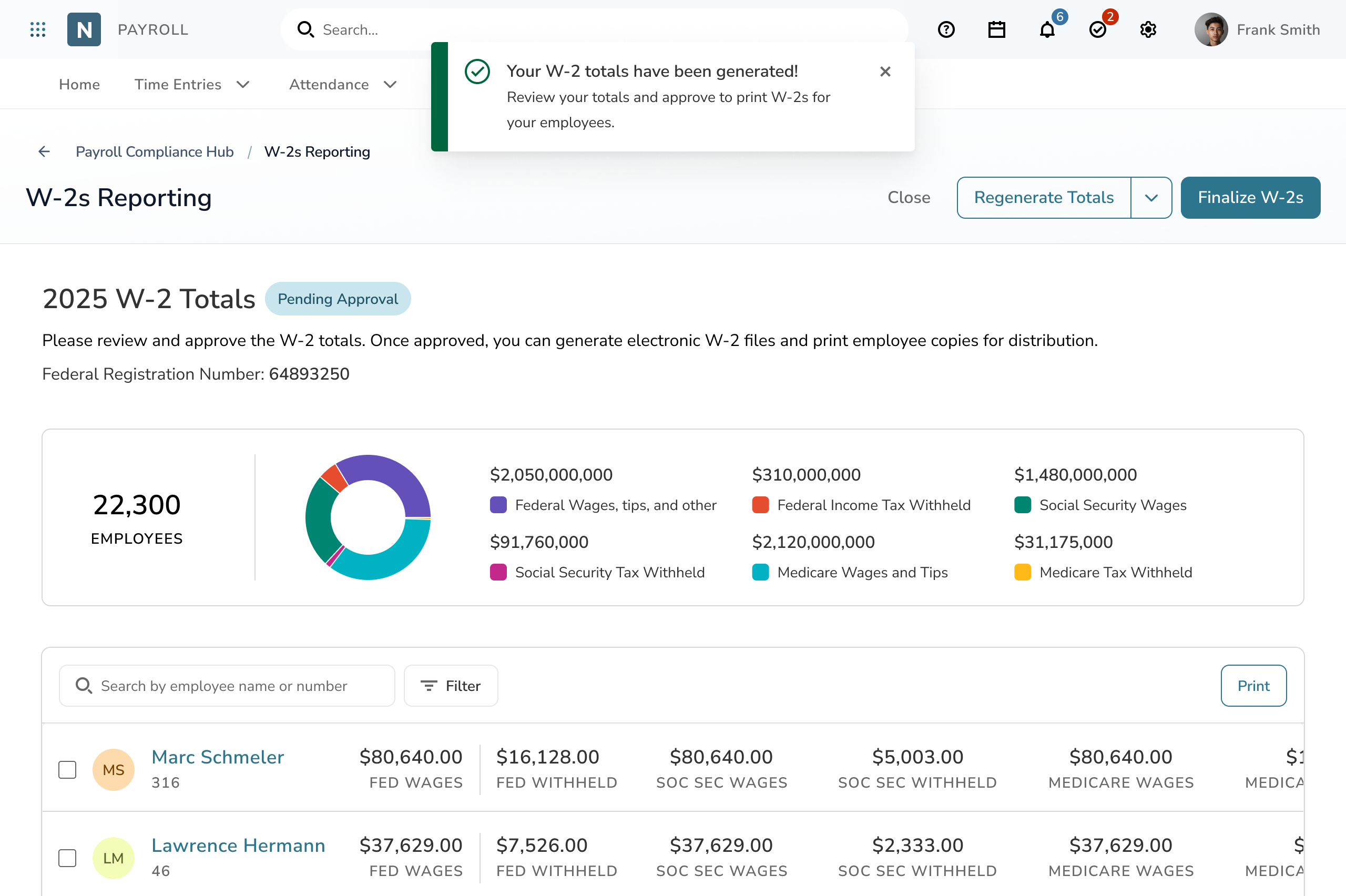

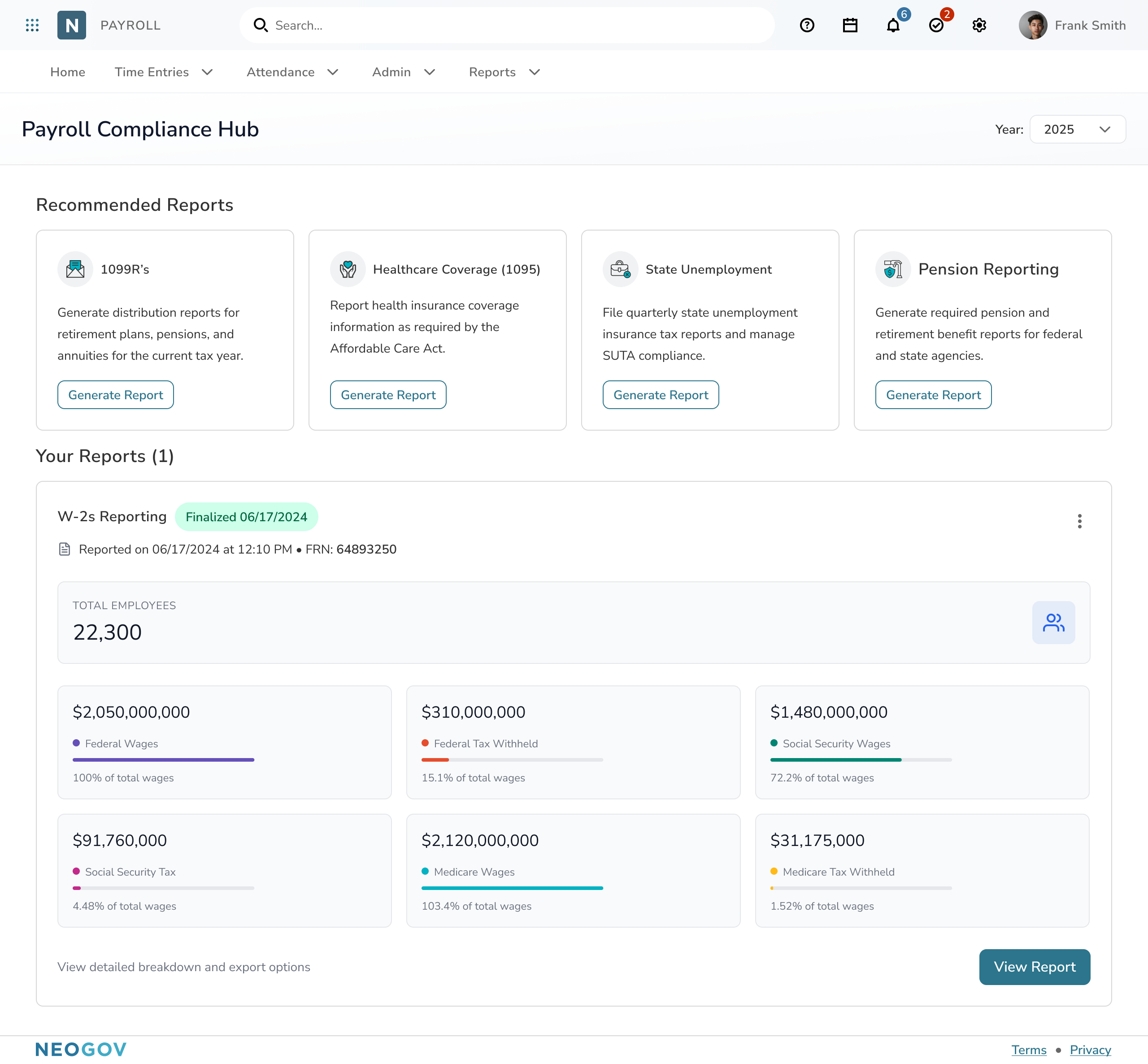

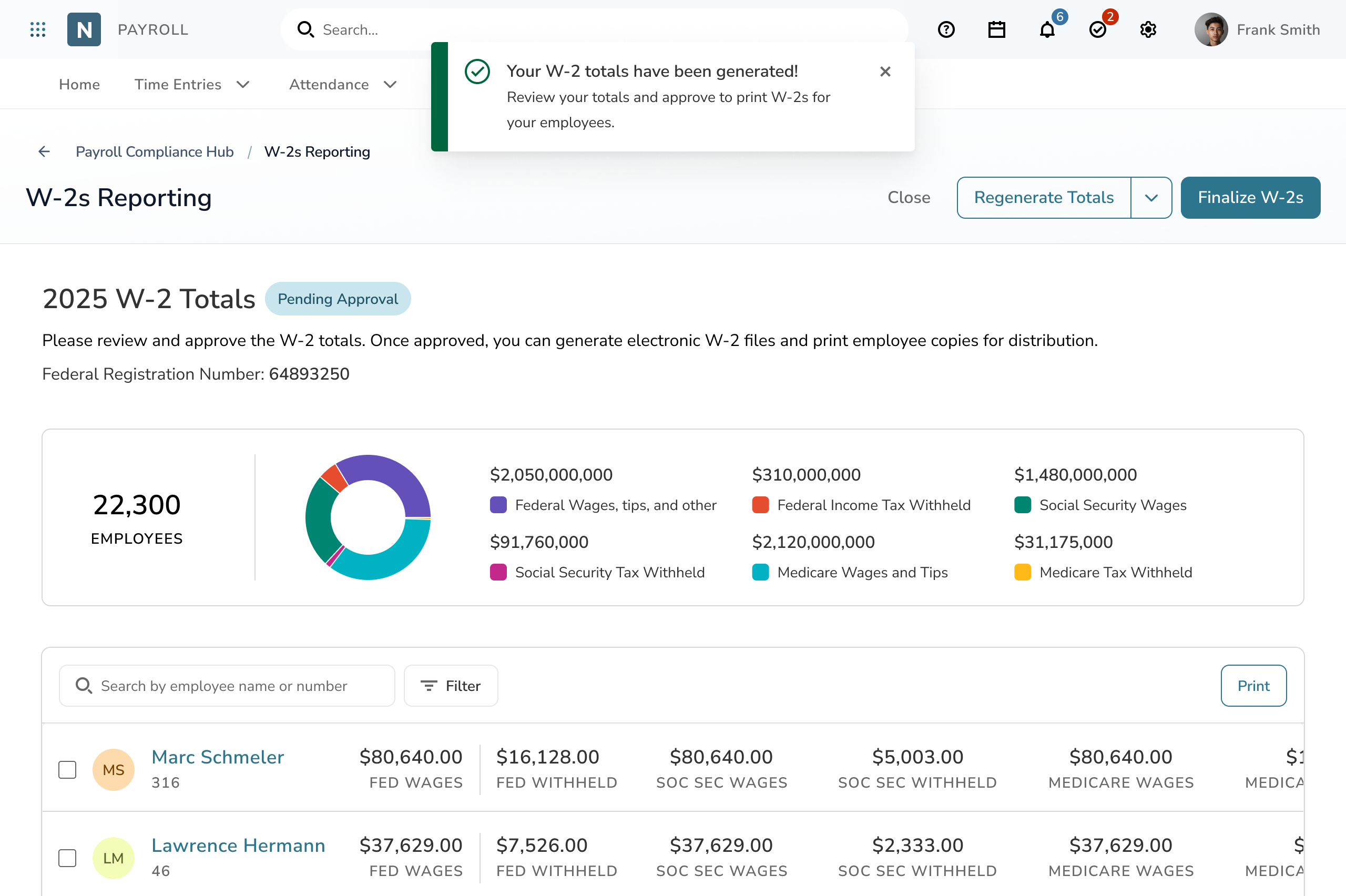

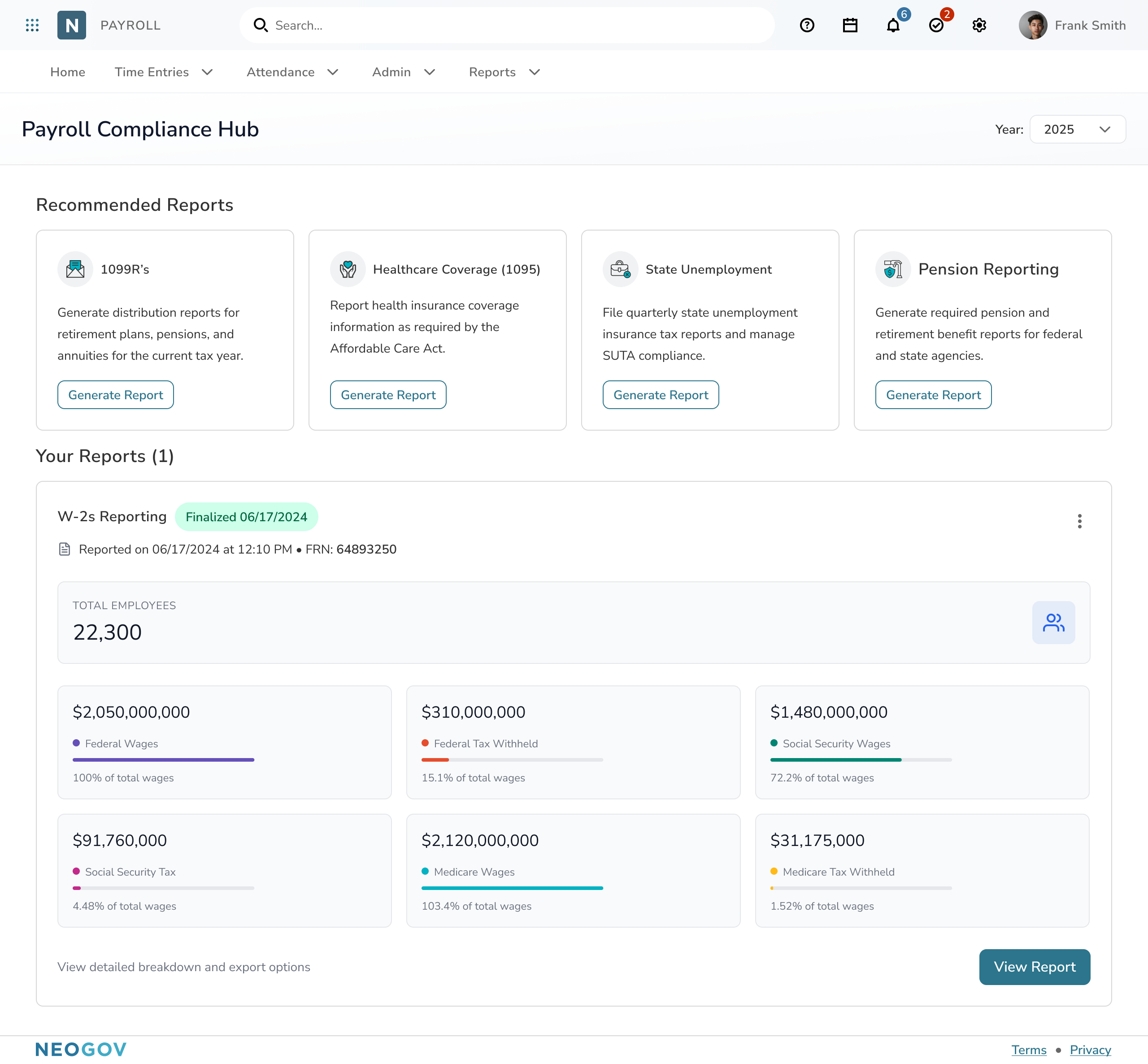

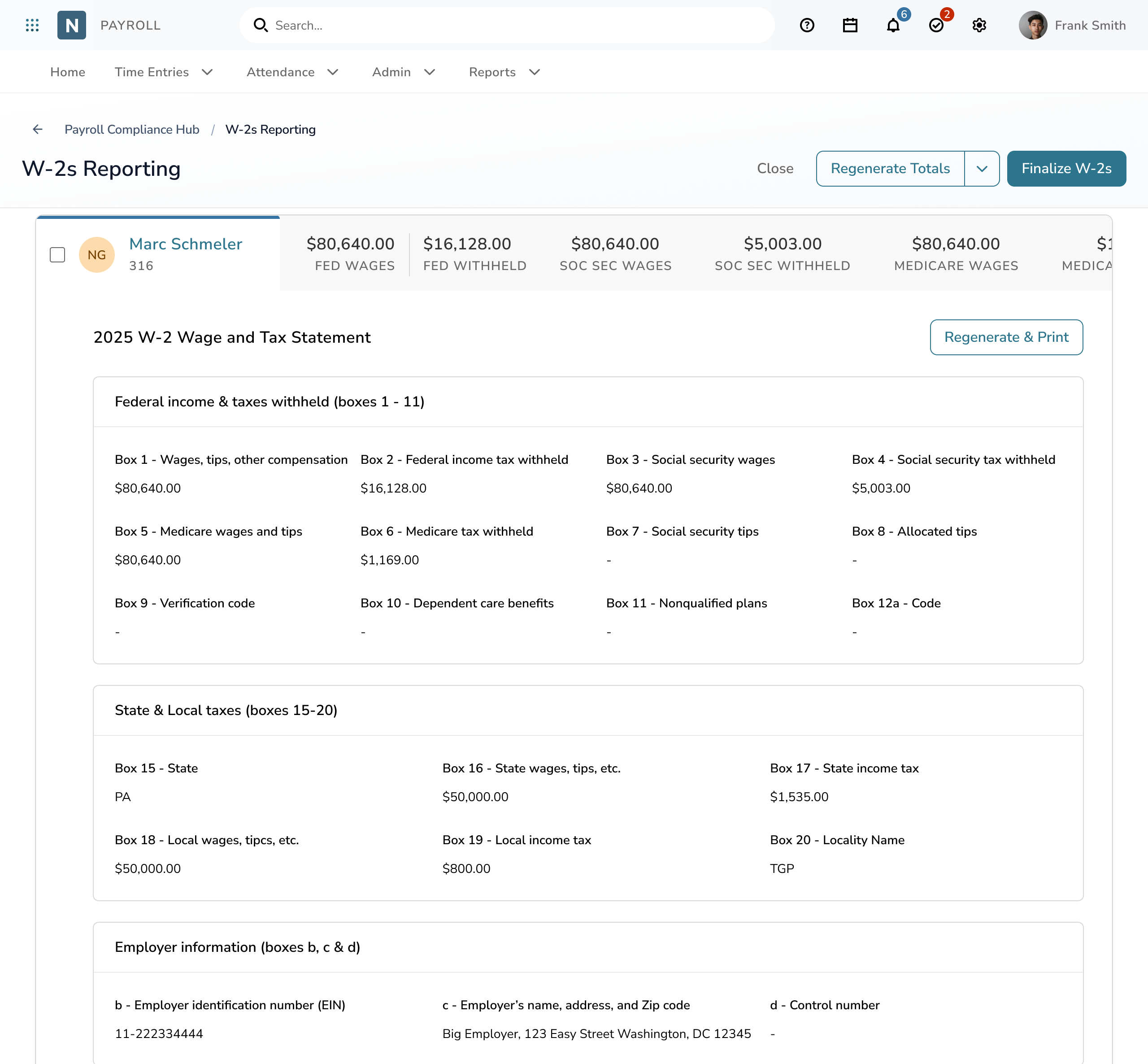

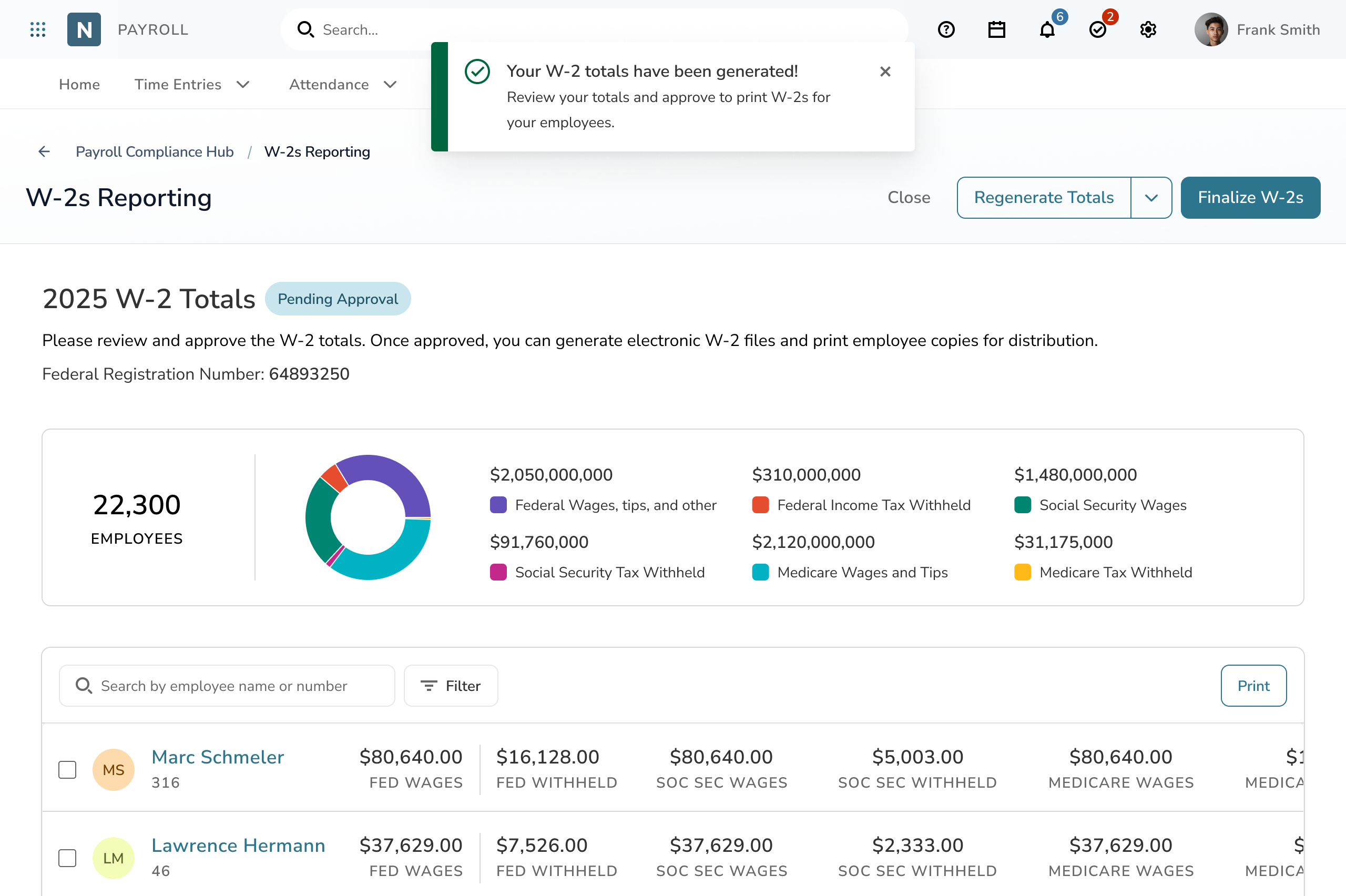

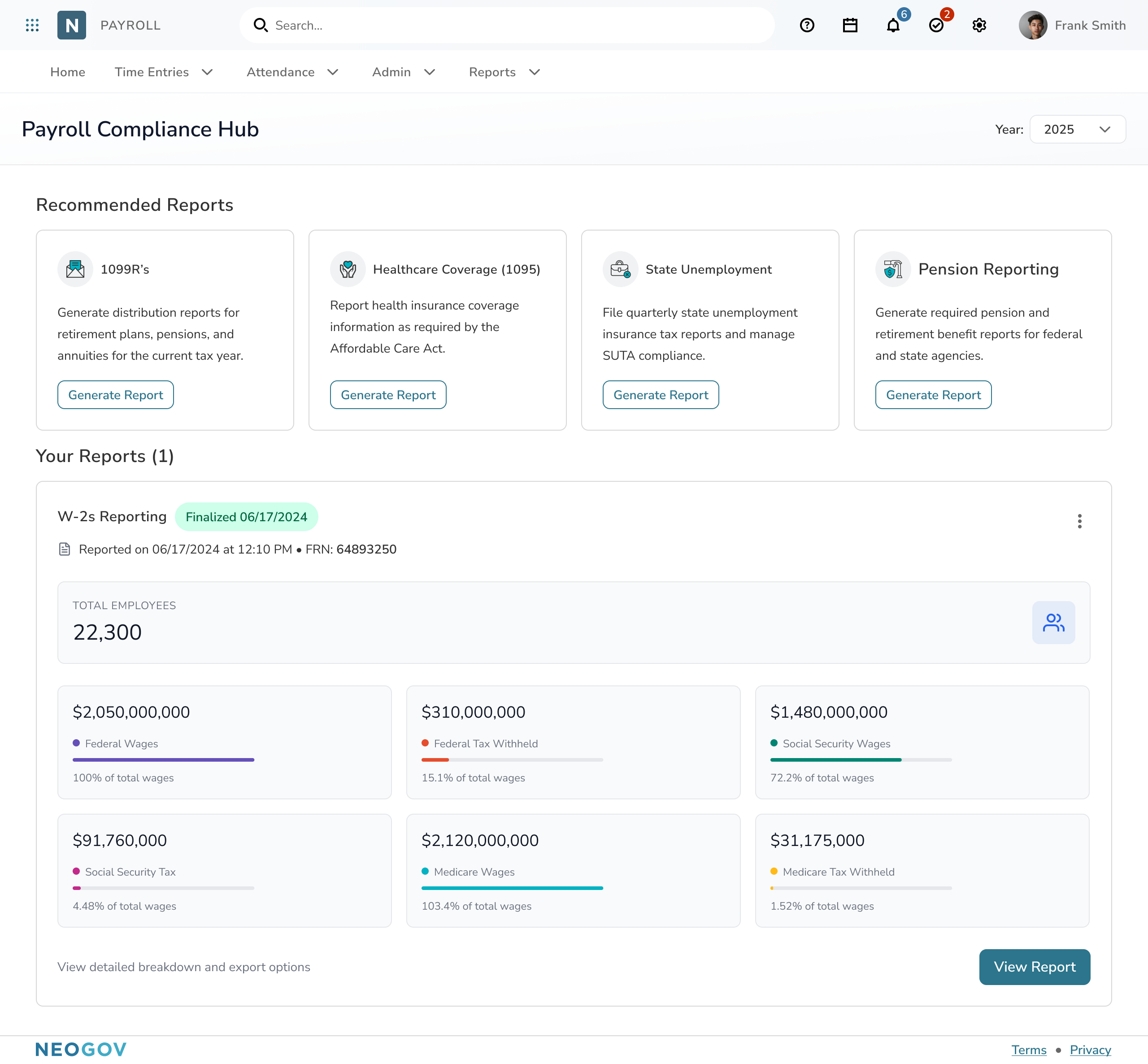

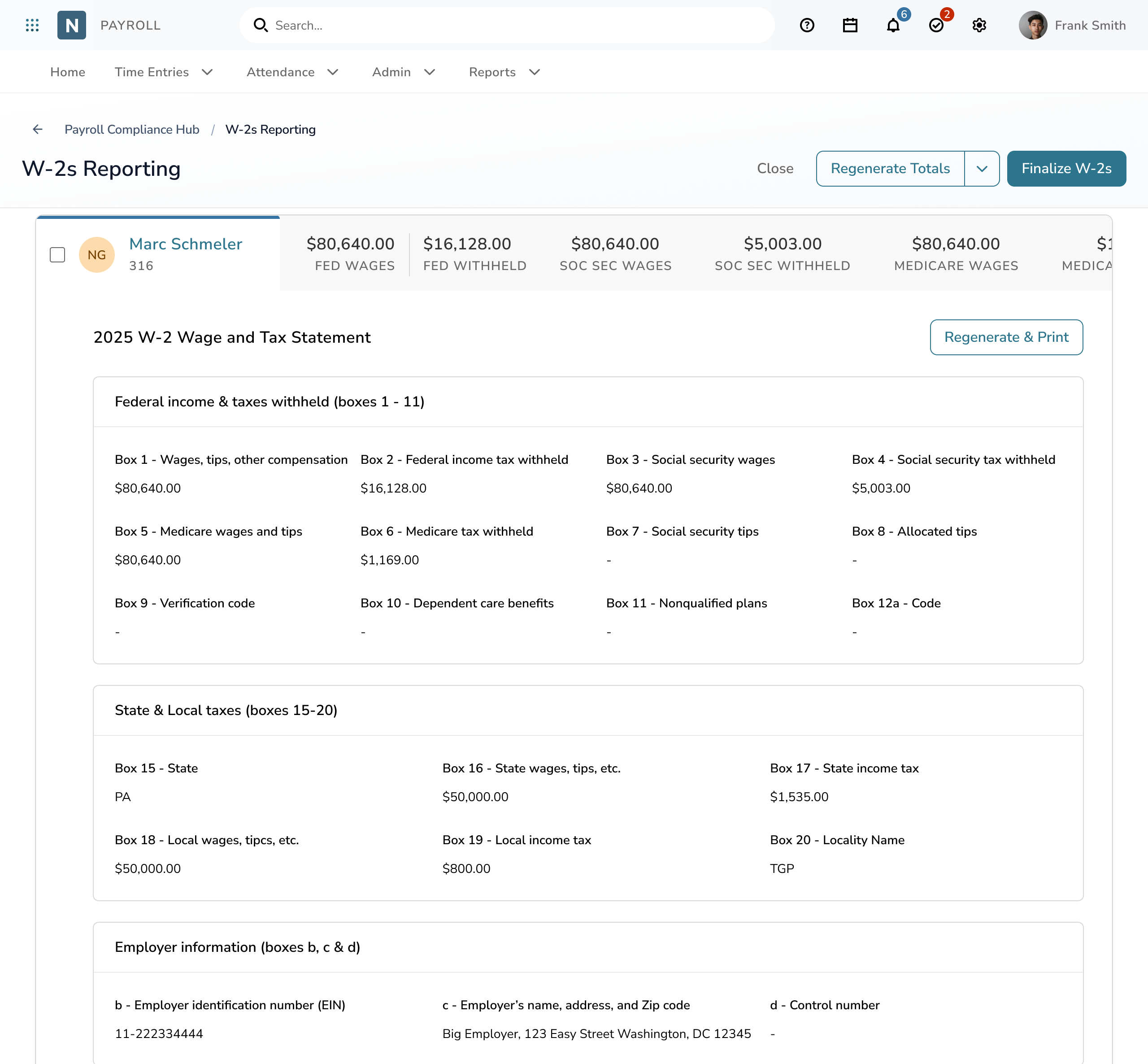

A unified Payroll Compliance Hub that brings year-end tasks into one workflow, provides real-time validation, and gives agencies full visibility from generation to submission.

Centralizing a Fragmented Workflow

Teams bounced between screens and external spreadsheets to complete a single W-2 cycle.

Consolidated the full process into one guided flow with clear hierarchy, predictable steps, and unified status visibility.

Impact: Reduced cross-system switching, fewer EIN-selection mistakes, and higher completion confidence across agencies, contributing to strong early adoption.

Reducing Errors Through Proactive Guidance

Critical configuration issues weren’t surfaced until late in the process.

Introduced setup guidance, inline validation, and time-sensitive alerts to catch issues earlier.

Impact: Fewer late-stage corrections and improved on-time submissions across multi-EIN agencies.

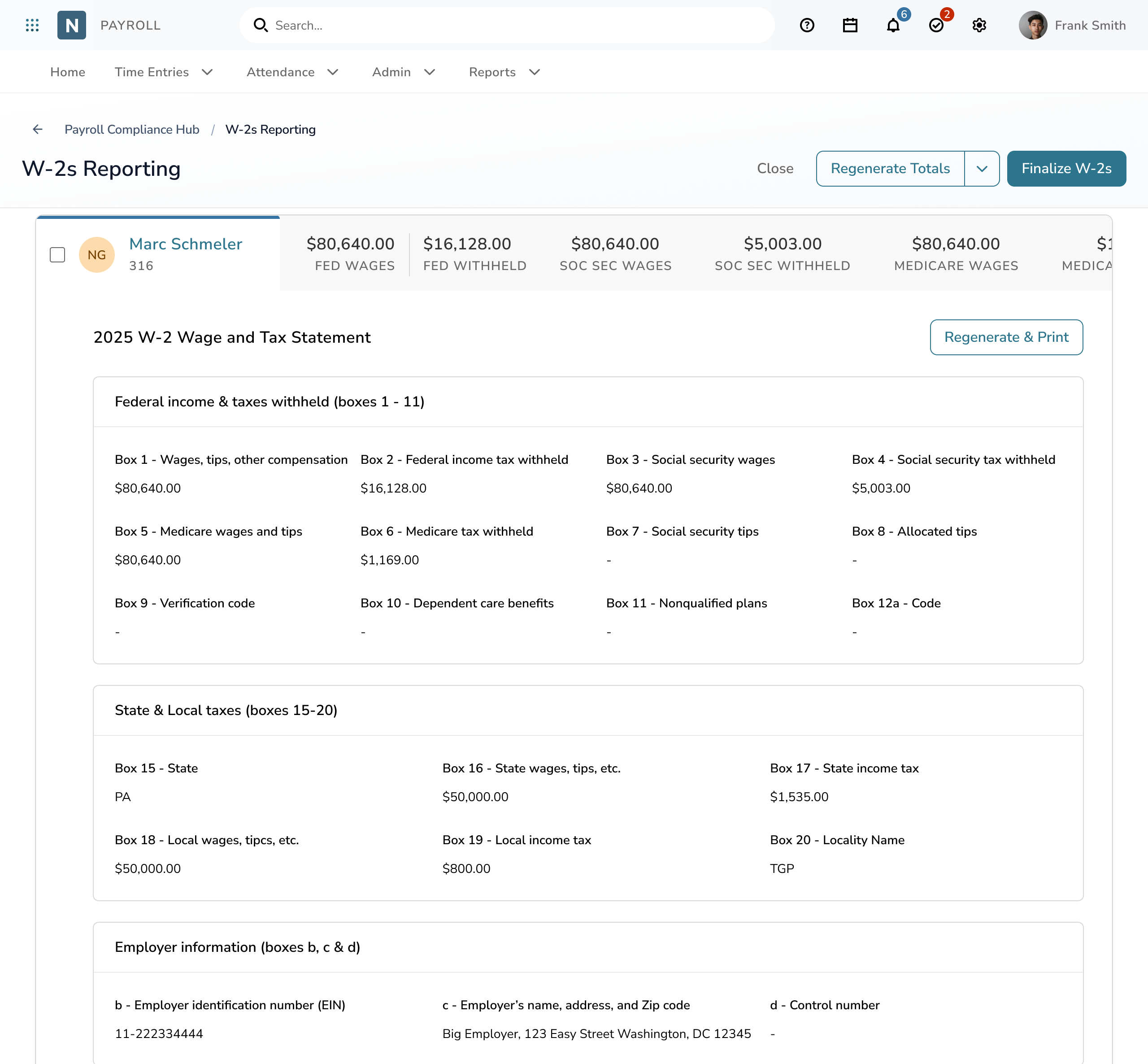

Strengthening Data Visibility and Trust

Payroll admins exported data to validate totals and verify wage breakdowns.

Designed a transparent totals view with rollups, jurisdiction-level detail, and contextual breakdowns.

Impact: Teams validated data in-system, decreasing reliance on spreadsheets and improving trust in calculated values.

Learnings

What this project taught me about designing for complex, high-stakes workflows:

Start with Real Workflows

Share Early, Share Rough

Align Through Collaboration

Other Projects 👇

A redesigned workflow that gives HR teams a faster, more transparent way to manage grades and steps.

View project →

A new import workflow that gives HR teams a clear, guided way to validate and upload historical documents.

View project →

Home

About

Resume

65% agency adoption and improved year-end accuracy for W-2 reporting

Unified year-end reporting into one trusted workflow, replacing fragmented processes and reducing compliance risk for more than 200 public sector agencies.

Lead Product Designer

Project Manager, Dev Lead, QA

12 weeks

SaaS platform for government HR and payroll teams

KPI Highlights

65%

$4M+

15%

The Problem

Payroll teams relied on disconnected screens and spreadsheets to validate data before filing W-2s. This created unnecessary cognitive load, manual rework, and accuracy risks during the most time-sensitive period of the year.

Project Goal

Create a unified, reliable experience for year-end reporting that:

Reduce Manual Work

Improve Clarity

Increase Filing Confidence

Foundational Learning: Understanding the Payroll Compliance Ecosystem

I began by grounding the work in the compliance ecosystem and real workflows:

IRS W-2 Requirements

W-2c Correction Logic

Payroll Data Structures

Legacy Workflow Audit

From Context to Discovery

With the compliance basics in place, I moved into structured discovery to understand how year-end reporting actually works in practice.

(2-week sprint)

Week 1

Weeks 2–4

Payroll admins and HR specialists with hands-on W-2, ACA, and 1099 reporting responsibilities.

What the Research Revealed

Over 12 user interviews (payroll admins across multiple agencies) validated the core problems:

Too many disconnected screens

Renne Hotz, Mohave Community College

Manual spreadsheet work

Tiffany Alsdorf, City of Durango

High cognitive load during deadlines

Ashli Perez, City of Arizona

Unclear state and local filing paths

Emily Wolf, City of Wildomar

Mapping the real workflow exposed where reporting breaks down

From Insights to Requirements

Once we synthesized what we heard, we shifted into weekly working sessions with PM, engineering, and payroll SMEs. The goal was to align on what the product should support immediately and what should wait, so we could reduce risk and increase clarity for both users and delivery teams.

We translated the findings into a shared problem statement and high level MoSCoW priorities that guided scope across the first release.

How might we create a unified reporting experience that supports real year-end complexity while reducing the manual checks, fragmented steps, and risks payroll teams face today?

Rapid Low Fidelity Exploration

With the scope aligned, the first sprint focused on fast iteration. I explored multiple layout patterns, workflow sequences, and validation approaches at a fidelity that encouraged honest critique.

SME Alignment and Domain Validation

Internal HR and payroll experts pressure tested early thinking. Their experience validated the problem and exposed gaps that users expect systems to solve.

— Payroll Compliance SME

— HRIS SME

— Implementation Consultant

Mid Fidelity Refinement and Visual Direction

By sprint five, the workflow, logic, and dependencies were defined. This was the moment to clarify how the experience should feel in practice.

That meant:

Where We Are At Now

Alignment

Confidence

Momentum

What We Delivered

A unified Payroll Compliance Hub that brings year-end tasks into one workflow, provides real-time validation, and gives agencies full visibility from generation to submission.

Centralizing a Fragmented Workflow

Teams bounced between screens and external spreadsheets to complete a single W-2 cycle.

Consolidated the full process into one guided flow with clear hierarchy, predictable steps, and unified status visibility.

Impact: Reduced cross-system switching, fewer EIN-selection mistakes, and higher completion confidence across agencies, contributing to strong early adoption.

Reducing Errors Through Proactive Guidance

Critical configuration issues weren’t surfaced until late in the process.

Introduced setup guidance, inline validation, and time-sensitive alerts to catch issues earlier.

Impact: Fewer late-stage corrections and improved on-time submissions across multi-EIN agencies.

Strengthening Data Visibility and Trust

Payroll admins exported data to validate totals and verify wage breakdowns.

Designed a transparent totals view with rollups, jurisdiction-level detail, and contextual breakdowns.

Impact: Teams validated data in-system, decreasing reliance on spreadsheets and improving trust in calculated values.

Learnings

What this project taught me about designing for complex, high-stakes workflows:

Start with Real Workflows

Share Early, Share Rough

Align Through Collaboration

Other Projects 👇

A redesigned workflow that gives HR teams a faster, more transparent way to manage grades and steps.

View project →

A new import workflow that gives HR teams a clear, guided way to validate and upload historical documents.

View project →

Home

About

Resume

65% agency adoption and improved year-end accuracy for W-2 reporting

Unified year-end reporting into one trusted workflow, replacing fragmented processes and reducing compliance risk for more than 200 public sector agencies.

Lead Product Designer

Project Manager, Dev Lead, QA

12 weeks

SaaS platform for government HR and payroll teams

KPI Highlights

65%

$4M+

15%

The Problem

Payroll teams relied on disconnected screens and spreadsheets to validate data before filing W-2s. This created unnecessary cognitive load, manual rework, and accuracy risks during the most time-sensitive period of the year.

Project Goal

Create a unified, reliable experience for year-end reporting that:

Reduce Manual Work

Improve Clarity

Increase Filing Confidence

Foundational Learning: Understanding the Payroll Compliance Ecosystem

I began by grounding the work in the compliance ecosystem and real workflows:

IRS W-2 Requirements

W-2c Correction Logic

Payroll Data Structures

Legacy Workflow Audit

From Context to Discovery

With the compliance basics in place, I moved into structured discovery to understand how year-end reporting actually works in practice.

(2-week sprint)

Week 1

Weeks 2–4

Payroll admins and HR specialists with hands-on W-2, ACA, and 1099 reporting responsibilities.

What the Research Revealed

Over 12 user interviews (payroll admins across multiple agencies) validated the core problems:

Too many disconnected screens

Renne Hotz, Mohave Community College

Manual spreadsheet work

Tiffany Alsdorf, City of Durango

High cognitive load during deadlines

Ashli Perez, City of Arizona

Unclear state and local filing paths

Emily Wolf, City of Wildomar

Mapping the real workflow exposed where reporting breaks down

From Insights to Requirements

Once we synthesized what we heard, we shifted into weekly working sessions with PM, engineering, and payroll SMEs. The goal was to align on what the product should support immediately and what should wait, so we could reduce risk and increase clarity for both users and delivery teams.

We translated the findings into a shared problem statement and high level MoSCoW priorities that guided scope across the first release.

How might we streamline year-end reporting into a confident, end-to-end workflow with built-in visibility and validation?

Rapid Low Fidelity Exploration

With the scope aligned, the first sprint focused on fast iteration. I explored multiple layout patterns, workflow sequences, and validation approaches at a fidelity that encouraged honest critique.

SME Alignment and Domain Validation

Internal HR and payroll experts pressure tested early thinking. Their experience validated the problem and exposed gaps that users expect systems to solve.

— Payroll Compliance SME

— HRIS SME

— Implementation Consultant

Mid Fidelity Refinement and Visual Direction

By sprint five, the workflow, logic, and dependencies were defined. This was the moment to clarify how the experience should feel in practice.

That meant:

Where We Are At Now

Alignment

Confidence

Momentum

What We Delivered

A unified Payroll Compliance Hub that brings year-end tasks into one workflow, provides real-time validation, and gives agencies full visibility from generation to submission.

Centralizing a Fragmented Workflow

Teams bounced between screens and external spreadsheets to complete a single W-2 cycle.

Consolidated the full process into one guided flow with clear hierarchy, predictable steps, and unified status visibility.

Impact: Reduced cross-system switching, fewer EIN-selection mistakes, and higher completion confidence across agencies, contributing to strong early adoption.

Reducing Errors Through Proactive Guidance

Critical configuration issues weren’t surfaced until late in the process.

Introduced setup guidance, inline validation, and time-sensitive alerts to catch issues earlier.

Impact: Fewer late-stage corrections and improved on-time submissions across multi-EIN agencies.

Strengthening Data Visibility and Trust

Payroll admins exported data to validate totals and verify wage breakdowns.

Designed a transparent totals view with rollups, jurisdiction-level detail, and contextual breakdowns.

Impact: Teams validated data in-system, decreasing reliance on spreadsheets and improving trust in calculated values.

Learnings

What this project taught me about designing for complex, high-stakes workflows:

Start with Real Workflows

Share Early, Share Rough

Align Through Collaboration

Other Projects 👇

A redesigned workflow that gives HR teams a faster, more transparent way to manage grades and steps.

View project →

A new import workflow that gives HR teams a clear, guided way to validate and upload historical documents.

View project →